At Team AlphaX, we’re more than a stage. We’re a movement.

Our community thrives on curiosity. We experiment, we exchange, we build. Because Alpha isn’t found in isolation — it’s created when the brightest minds collide.

When you join Team AlphaX, you’re joining a tribe that understands your world — the pressure, the pace, the precision — and pushes you to go further.

What We Explore - Together:

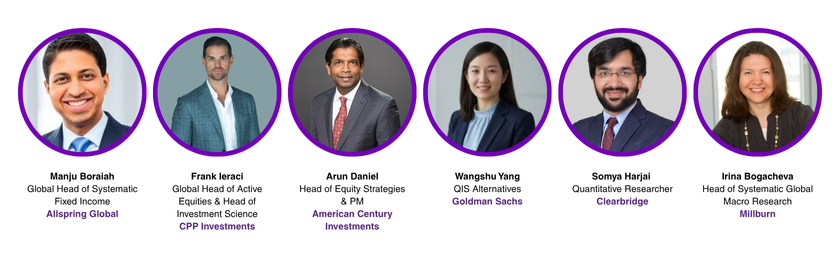

Who's already in the AlphaX Team:

Unlock the AlphaX Sessions & Speakers Here