At Team TechX, we don’t just build platforms - we build the future of multi-asset execution.

Join CTOs, Heads of Trading Infrastructure, and Platform Architects who are benchmarking approaches, sharing challenges, and discovering how AI-infused technologies can transform the way markets are approached. Together, we create smarter, faster, and more resilient technology ecosystems.

What We Explore - Together:

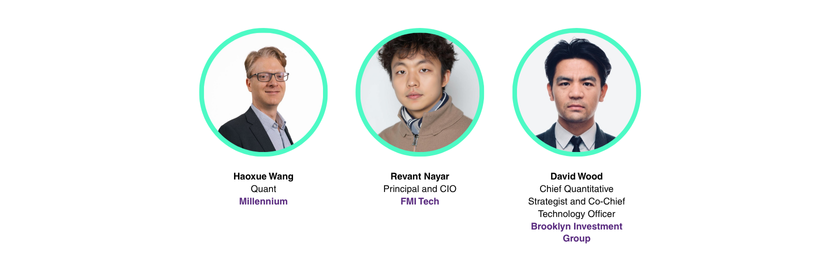

Who's already in the TechX Team:

Unlock the TechX Sessions & Speakers Here

Or, if your curiosity points elsewhere, explore Team AlphaX & RiskX.