Welcome to Team RiskX - a collective of leaders who believe that managing risk isn’t about reacting to markets, it’s about shaping them.

We know that true strength in finance comes from collaboration; from sharing insights, debating models, and learning from diverse perspectives.

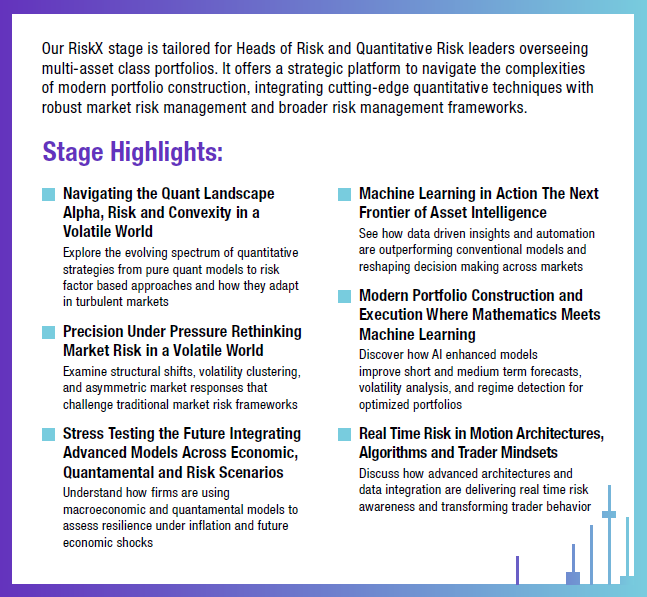

At RiskX, we connect the minds building the future of quantitative risk management - where advanced techniques meet real-world strategy, and every discussion sharpens our collective intelligence.

What We Explore - Together:

Who's already in the RiskX Team:

Unlock the RiskX Sessions & Speakers Here

Or, if your curiosity points elsewhere, explore Team AlphaX & TechX.